ev tax credit 2022 cap

Current EV tax credits top out at 7500. The revenue procedure contains a table providing maximum EITC amount for other categories income thresholds and phase-outs.

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

What Is the New Federal EV Tax Credit for 2022.

. For preapprovals processed through the date of this report 81863478 of the 100 million cap has been preapproved. Keep in mind that the Canada EV incentives and rebates listed above may change depending on program availability. If an EV buyer has a tax bill of say 3000 at the end of the year the EV tax credit can only be a maximum of 3000.

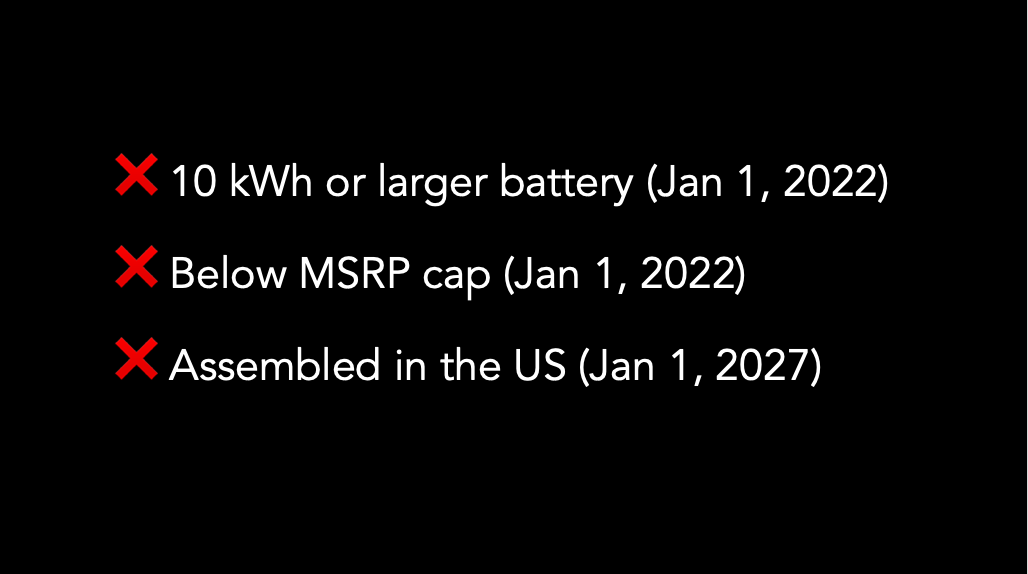

We are financial advisors in La Jolla CA. President Bidens EV tax credit builds on top of the existing federal EV incentive. As mentioned below however the 10 kWh.

Automotive Editor - January 7 2022. You may be eligible for a credit under section 30D g if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 25. As such there is 18136522 remaining in the cap.

The Japanese automaker which has offered hybrids and plug-in hybrids longer than the majority of other brands is about to hit the 200000-vehicle cap for the current federal tax credit limit. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles. Toyota is about to launch the all-electric bZ4X electric SUV in the middle of 2022 but its going to be in a tricky situation.

All-electric and plug-in hybrid cars purchased new in or after. Heres how you would qualify for the maximum credit. In this blog we will discuss what the credit is how it works and more.

Congress is mulling over passing the Build Back Better Act which would increase the maximum electric vehicle tax credit to 12500 in 2022. The Week in Reverse Bengt Halvorson April 2 2022 Comment Now. The federal program will provide 300 million towards these credits until December 31st 2023 and the program is offered on a first-come first-served basis.

The tax year 2022 maximum Earned Income Tax Credit amount is 6935 for qualifying taxpayers who have three or more qualifying children up from 6728 for tax year 2021. Federal Tax Credit Up To 7500. The Clean Energy Act for America would benefit Tesla by allowing most Tesla vehicles to qualify for an 8000 House version or 10000 Senate version refundable EV electric vehicle tax credit while discouraging Chinese EVs from entering the US market.

Federal EV tax credits of 2500-7500 are available for new EVs and plug-in hybrids but not for hybrids. The credit applies to the year you buy the vehicle and your tax credit is capped at how. The current tax credit has a base of 2500 and is replaced with a new 4000 base credit as long as the EV has a battery of at least 10 kWh and can be plugged in and recharged.

How Much is the Electric Vehicle Tax Credit for a 2021 Tesla. QUALIFIED EDUCATION EXPENSE TAX CREDIT January 31 2022 The Qualified Education Expense Credit Cap is 100 million 2022 Year. 4000 Base Tax Credit.

The exceptions are Tesla and General Motors whose tax credits have been phased out. Taxpayers may receive up to 7500 as a federal tax credit for electric cars in 2022. Senate passes measure for 40000 cap on the EV tax credit and only EVs priced under 40000 would be eligible for 7500 credit under this plan.

Increasing the base credit amount to 4000 from 2500 is fine. 2022 Calendar Year Federal Poverty Level Information. The credit ranges between 2500 and 7500 depending on the capacity of the battery.

Based on our recent estimates and forecast Toyota will be the next manufacturer to reach the 200000 tax credit phaseout threshold likely in Q1 of 2022. Toyota and Nissan EV tax credit Vinfast US plant breaking down the EV partisan divide. The new credits if Biden and Democrats finalize a deal would jump to 12500 maximum.

To qualify automakers must build the EV in the US with union labor for an extra 4500 over the current. A Made in America EV tax credit what car buyers need to know if Biden can advance a sliced-and-diced Build Back Better bill Provided by. The credit begins to phase out for a manufacturer when that manufacturer sells 200000 qualified vehicles.

The federal EV tax credit may go up to 12500 EV tax credit for new electric vehicles. The IRS will not go over and above this total tax liability figure and in this example the remaining 4500 of the EVs total tax credit will not be useable. There is a federal tax credit of up to 7500 available for most electric cars in 2022.

Ford is most likely to quickly follow Toyota and reach 200000 sales of EVs in Q3 2022 followed by Nissan but not until at least Q2 or Q3 of 2023.

Road Tax Company Tax Benefits On Electric Cars Edf

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Tesla Toyota And Honda Criticize 4 500 Tax Credit For Union Made Evs

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

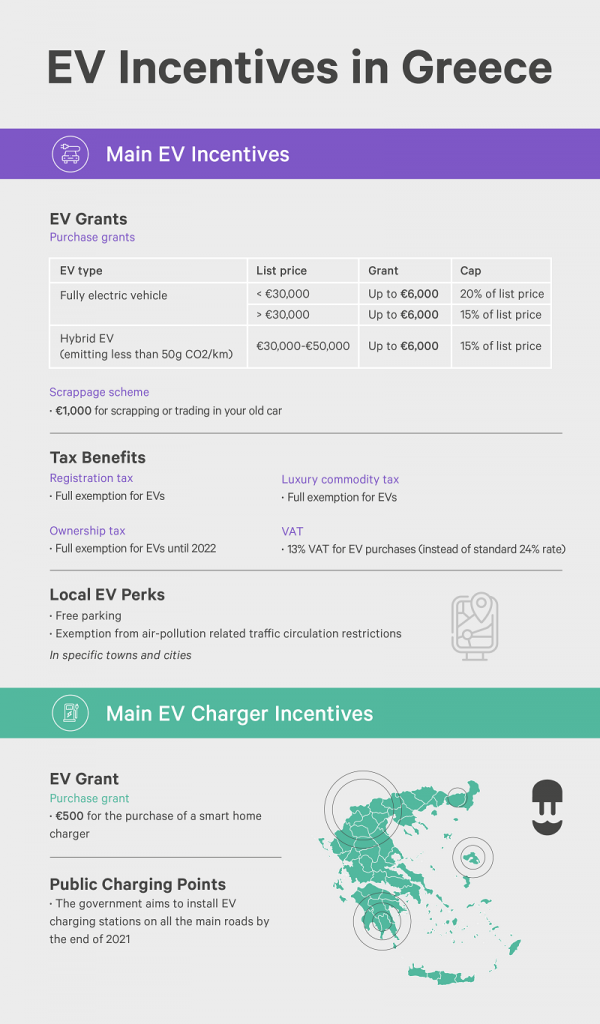

Ev Ev Charging Incentives In Greece A Complete Guide Wallbox

Road Tax Company Tax Benefits On Electric Cars Edf

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

The Tax Benefits Of Electric Vehicles Saffery Champness

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Budget 2022 Main Points What S In It For You

Ev Incentive Hike Faces Tortuous Path Through Congress Forbes Wheels

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Roadshow

Ev Ev Charger Incentives In Europe A Complete Guide For Businesses Individuals